What to Expect When You’re Expecting (a Background Check)

When will it be here? What will it look like? How much is it going to cost you? Wait a minute, is it even yours?

Whether you are leasing an apartment, hiring a new employee or contracting with a vendor, background screening reports require a little bit of time, patience and understanding.So maybe the anticipation of expecting a background check isn’t as exciting as waiting for a child to arrive, but the similarities noted below are worth a quick read. For the purposes of this article, let’s focus on background screening reports procured for the purposes of Employee Screening and Tenant Screening (aka Consumer Reports and Investigative Consumer Reports).

What to expect when you’re expecting, a background check.

When will it be here?

Second to accuracy, the turnaround time (TAT) of a background check is a high priority. Although it’s tempting to look only for an “instant criminal background check” - it’s important to note that proper due-diligence can take a little time. How much time? Well that depends on the type of report or verification you are requesting. As a good rule of thumb, I’d use this to help set expectations:

INSTANT: Identity Verification, Credit History, MVR Driver License records, and certain database searches for Evictions, Criminal, Sex Offender, and Government Sanction Lists (such as known Terrorists).

1 BUSINESS DAY: County Criminal Court Search (with automation via electronic record retrieval), Federal District Court Search, Professional License Verification, Education Verification and Employment Verification (with automation via a clearing house)

3 - 5 BUSINESS DAYS: Statewide Criminal Search (select states), Drug Testing

DELAYS: Certain states and jurisdictions may delay the turnaround of consumer reports due to delays in processing and procedural bottlenecks. In other cases, an instant criminal search may be delayed for further investigation as required under the FCRA.

What will it look like?

As of writing this, the National Association of Professional Background Screeners (NAPBS) has 441 regular members. With many of these members operating their own background screening companies, it goes without saying that not all background reports will look the same. However if you are using a Consumer Reporting Agency that adheres to State and Federal Fair Credit Reporting Act (FCRA) laws, there should be a common theme when identifying what it will look like. At a minimum, every background screening report should contain the following:

- Unique Report Identification Number

- Report Status (Pending, Canceled, Complete, etc)

- Time Stamp of Date Requested

- Time Stamp of Date Completed

- Consumer Information (as entered by requester)

- ID Verification / SSN Trace (validates identity and jurisdictions for search)

- Consumer Report Data and/or Investigative Consumer Report Data For example, this may include (by section) a:

- Criminal Check

- Credit Check

- Driver License Verification

- Professional Reference Check

- Employment and Education Verification

- Other

- Contact Information for Consumer Reporting Agency

Click below to preview a sample background check

How much is this going cost?

The cost of a background check can vary greatly depending on the company furnishing the report, as well as the level of detail and jurisdiction(s) being researched. As we’ve discussed in our “Cost of a Background Check” post, there are flexible options available depending on your industry, budget, and tolerance for risk. On average, an Identity Verification, SSN Trace, National Criminal Database, National Sex Offender Search, and County Criminal Court Search will cost between $30 and $35.

Is it even yours?

One of the most important elements to a compliant background check is accuracy. I can’t emphasize this enough. In a world where information is at our fingertips, it’s easy to fall into the trap of expecting everything fast and on-demand. When conducting a background check on a prospective tenant or employee however, it’s important to understand that internet database searches alone may not properly filter consumer information. As more and more courts and public record databases aim to protect the identity of consumers, unique identifiers like a Social Security Number are being removed from search criteria. This makes matching the records for accuracy more laborious and should include a ‘human eye’ in the review process (prior to releasing landlords and employers with the outcomes). Compliance filtering (both systemically and manually) may include FCRA related compliance attributes such as: Removal of mixed file consumer information, Criminal records filtered by disposition (arrest vs. conviction), State FCRA compliance including removal of convictions based on release date, etc.

The hype is over, now what?

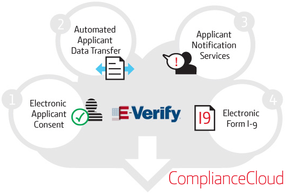

When expecting a background check or evaluating a background screening provider, its important to make sure you understand the value of compliance. Partner with a screening company that can help educate its customers on their responsibilities under the FCRA (for starters, grab a copy of “Notice to Users of Consumer Reports”). Continued education and training will help Landlords and Employers better understand the timing of applicant disclosure and consent, pre-adverse action and adverse action notification, as well as dispute resolution and more. To help, VeriFirst has designed a Compliance Cloud that formalizes and centralizes end-user compliance, as well as Form I-9 and E-Verify eligibility.

Learn more by visiting the link below.

Share this

You May Also Like

These Related Stories

What to Expect on an FCRA Compliant Background Report

How to Choose the Best Employment Background Check Company